PROBLEM TO ADDRESS: It is a daily job for finance practitioners to collect and reason over a lot of data to make swift decisions. For example, listing potential acquirers for a specific business, or screening acquisition targets in accordance to certain criteria. Such work could usually take long hours to finish and involve reviewing information from multiple sources.

MISSION: FMeasure is dedicated to making this process automatic, and producing results with human-readable explanations in seconds.

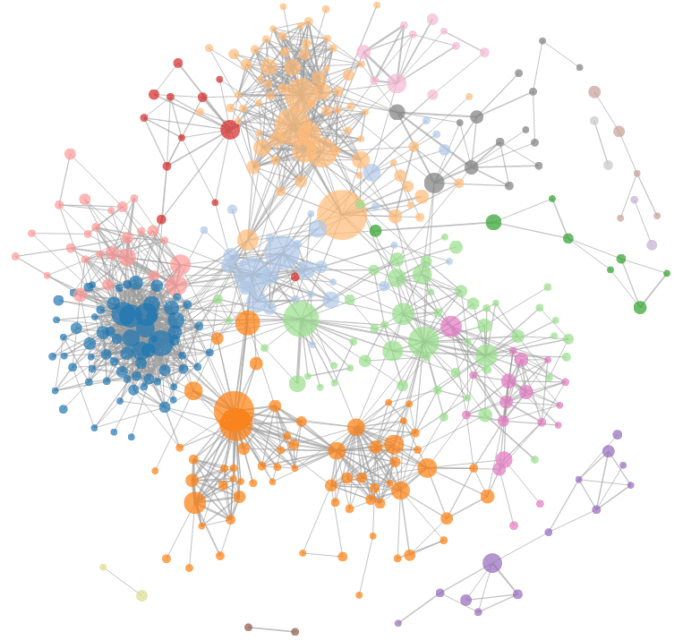

SOLUTION: We track and analyze financial data in real-time and integrate all results in a large financial knowledge graph. The knowledge graph is used for financial decision making and explanation generation.

USE CASES: Based upon the integrated data provided by our knowledge graph, we are able to deliver results with explanations for a number of common financial tasks like acquirer recommendation, market research report generation, and business search based on technologies.

FINANCIAL KNOWLEDGE GRAPH

Data: The data that we track includes

- Company financial statements, stock prices;

- Company filings and earning call transcripts;

- M&A transactions, funding round information, insider/institutional investor activities;

- Company meta data covering both public and private companies;

- Public employee information;

- News, trademarks, papers and patents;

Integration: Data from different sources is processed and integrated using the state of the art natural language processing and machine learning techniques.

Pipeline: Built on top of the knowledge graph and a set of built-in natural language processing and machine learning components, a pipeline is assembled to reason over the integrated data, and then produce final results for a given task.

.

USE CASES

M&A Service for Corporations

Recommend potential acquirers and screen acquisition targets.

Corporate R&D Analysis

Analyze companies from the perspective of research & development.